Introduction

The path to a student visa involves some essential steps, and a blocked account in Germany is central to this. This financial provision is necessary for your visa application and provides financial security during your stay in Germany. In the following sections, we will discuss the blocked account in detail.

What is a blocked Account?

A German blocked account is a special account that applicants open in Germany to get a visa from the German Embassy. Applicants need this account to demonstrate they have sufficient financial means to cover their stay in Germany. Before arriving in Germany, applicants must deposit €11,904 in this account.

Why do you need a Blocked Account in Germany?

The German Embassy or consulate may ask you to present proof of this account with €11,904 in funds at your appointment, or to send it later. After you arrive in Germany, you can withdraw €992 per month. Through this, they ensure you have sufficient funds to cover your living expenses, such as health insurance, rent, and food. To know more about the cost of living in Germany.

1: Who Needs to Open a Blocked Bank Account?

Applicants requiring long-term visas need to open a blocked account. You need one even if you belong to a country outside the European Union or a Schengen Member State, e.g., Korea, the USA, India, or Japan. It is compulsory if you are applying for a visa category, such as a Student visa, Job-seeker visa, Germany Opportunity Card (Chancenkarte), Training or apprenticeship visa, Au pair visa, a Visa for the recognition of foreign qualifications, or a Language course visa.

2: Who Does Not Need to Open a Blocked Bank Account?

You do not need a blocked account if

- Your country is in the European Union or a Schengen Member state

- You have an alternative financial sponsor

- Hold a scholarship

You can open a blocked account with one of the providers given below.

You can also open a blocked account directly at any bank, though this service is not available at every German bank branch. The German banks where you can consider opening a blocked account are listed below.

- Deutsche Kreditbank (DKB)

- Targobank

- Postbank

- Sparkasse

- HypoVereinsbank

- Volksbank

- Commerzbank

Note: To avoid potential problems or prolonged waiting times, open a blocked account only with a German bank or an approved provider.

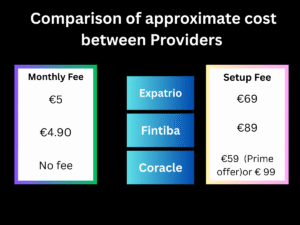

Comparison Between Blocked Account Providers

Provider | Fintiba | Expatrio | Coracle |

Setup Fee | €89 | €69 | €99(€59 with PRIME) |

Monthly Fee | €4.90 | €5 | €0 |

Common Buffer Amount | €100 | €100 | €80 |

Speed of Account Opening | >10 min | 1 working day | 2 to 24 hours |

Banking Partner | Sutor Bank | Aion bank | Lemonway SAS |

Linked Health Inssurance | Fintiba Plus | Value Package | PRIME package |

Linked german Current account | NO | Yes | NO |

Refund Policy | processing fee charged | processing fee charged | No processing fee charged |

Flexible Transfer | only as exception | Yes | Yes |

Travel inssurance included | Yes | Yes | Yes |

Online Application | Yes | Yes | Yes |

Required Amount for a Blocked Account:

The required amount for a German student visa in 2025 is €11,904. This amount is based on BAföG’s estimates of students’ annual living expenses, ensuring they have sufficient funds to cover their living costs in Germany. The monthly withdrawal limit is 992 €.

This amount is based on BAföG’s estimated annual living expenses for students.

Do certain visas require a higher deposit for a blocked account in Germany?

Some German visa applicants applying for specific visa categories, such as:

- Training or apprenticeship visa

- The language acquisition visa

may require you to deposit an additional 10%, bringing the total to €13,094.40, allowing you to withdraw €1,091.20 per month.

Am I allowed to deposit more than the required minimum amount?

According to German officials, students can deposit more than the required amount but not less than €11,904 for a study or residence permit. However, the providers do not recommend it, except for funds needed for international transfer, opening an account and maintaining it. If you think you will need more than this 992€ per month, you can have that money in a separate account for easy access.

Which option is better for opening a blocked account: using an intermediary or applying directly with a German bank?

If you are in Germany, going to the bank in person could be a good option because you can speak with bank employees and submit the necessary documents. This makes the process faster and transparent.

But if you are not in Germany, opening a blocked account directly can be difficult, as sending documents by mail takes additional time and effort. In this situation, intermediary companies like Fintiba, Expatrio, Studely, Coracle، or Drop Money offer simple solutions.

These companies work with German banks and complete the entire process online for you, saving time and effort. In simple terms, if you are in Germany, going in person to the bank is a better option; however, if you are abroad, getting help through these intermediary companies is easier and faster.

How can I open a Blocked Bank Account?

If you want to get a German visa or residence permit, you must open a blocked account. Most students complete this process from their country. However, the steps to open a blocked account depend on the provider; generally, they involve the following.

- Confirm the Amount: Visit the German embassy website or Consular Services Portal to confirm the amount you need to deposit in the blocked account. This amount is usually the same for students, though it’s better to check beforehand.

- Opening the Blocked Account: Open the blocked account with the provider of your interest. Most intermediary companies offer online facilities to open blocked accounts from your home. If you want to open a blocked account directly with a German bank, you may need to send your application documents through the German Embassy if you are in Germany.

- Wait until the application processing is complete:

- Transfer the funds: Once your account is opened, you will receive banking details, such as an IBAN, to transfer the funds. You can transfer these funds via bank transfer or an international money transfer service, and the process may take a week or two.

- Blocked Account Confirmation Document: Get the confirmation document via email when they receive the funds in an account. Submit this document to the German Embassy on your appointment day.

- Wait for Visa Approval: Your visa processing will start after you submit all necessary documents. If the documents are in order, you will receive a National D Visa to enter Germany.

When Should I Apply for a Blocked Bank Account?

- As soon as you receive a letter of admission from the university or confirmation of your studies in Germany, you will need to apply to open a blocked account. This is a mandatory visa requirement to show proof of financial support.

- The processing time for opening a blocked account can vary from a few days to several weeks, depending on the volume of the application.

- Sometimes students encounter issues when opening a blocked account, and the process takes longer than necessary.

- After opening a block account, the next step is to transfer the required funds to a German bank. Depending on the bank and its transfer policy, the transfer of funds may take additional time.

- Always apply early to avoid unnecessary stress.

- Completing these steps on time can help you focus on your following goals, such as packing and finding accommodation.

Can I Open a Blocked Account With a Foreign Bank?

No, you cannot open a blocked account in a foreign bank. The blocked account must be registered in Germany. Germany does not accept funds blocked by a foreign bank. By making this mistake, you can waste your time and end up having to transfer the money to a German bank. This can lead to delays in the process and visa rejection.

Can I Open a Blocked Account from Inside Germany?

Only people from countries such as:

- The United States of America

- Canada

- Israel

- Japan

- New Zealand

- South Korea

Can open a blocked account after entering Germany.

If they are from third-world countries such as India or Pakistan. You need a visa to enter Germany, so you need a confirmation letter for the blocked account before you go to the Embassy to get a residence permit.

Furthermore, it can take time to open a bank account in Germany and link it to your blocked account. You will not have any money when you arrive in Germany for at least the first three months. You should have at least an extra 1000 euros to cover these initial periods.

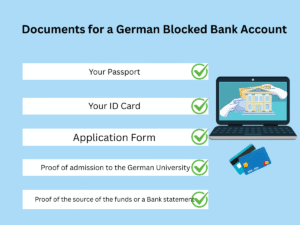

What Supporting Documents Do I Need?

How to Transfer Funds to Fund My Blocked Account?

- After opening the blocked account, you can transfer funds from your local bank to it. You will need an IBAN from your blocked account provider. However, keep in mind that this method may involve a Transfer fee or a Currency exchange fee. It can take longer to process.

- Moreover, the second method is to use an international money transfer app that offers more competitive rates.

- In addition, blocked account service providers can also inform you about the transfer options. Some providers have partnerships with specific money transfer services. For example, Fintiba provides a service to transfer your funds through its partners, xCurrency and Transfermate.

How Do I Activate My Blocked Bank Account?

After entering Germany, you must complete the required registration steps. First, open a current account with a German bank, such as

However, there are also online bank accounts. You can open an online bank account with N26, Comdirect, C24, or Revolut. You need the following documents to open a Bank account.

1: Residence Registration

To register your address at the local registration office (e.g. Ausländerbehörde or Bürgeramt). Upon registration, you will receive a registration certificate that you must submit to open a bank account and for further steps.

2: Current account

To open a current account in Germany, you will need a tax identification number (Steuer-ID) and a residence registration certificate from a local registration office.

3:German Residence Permit (Aufenthaltstitel)

Sometimes you can activate your blocked account initially without a German residence permit. Later still, the provider usually asks you to upload proof of a German Residence Permit in the online app. These blocked account providers, such as Fintiba, Coracle, and Expatrio, also have their own online Apps. You can easily upload your documents to these apps.

4: Passport with an entry stamp

With ID documents, a registration certificate and a current account, you can activate your blocked account and link your current account with your blocked account to get funds every month.

How do I access my blocked account after arriving in Germany?

Follow the steps given below after arriving in Germany to access your blocked account.

- Get your residence permit: The first step to activating your blocked account is to apply for the residence permit at the immigration office (Ausländerbehörde) within the first three months of your arrival in Germany.

- Activate your blocked account: Once you receive your residence permit, you can activate it. If you used any intermediary company to open a blocked account, log in to their website or open their app and upload your residence permit along with other essential documents. On the other hand, if you opened it directly with a German bank, visit the local branch in your city of residence with the necessary documents to activate your blocked account.

- Activate current account: You will need a current account to access your funds from a blocked account. You can open it in the same bank or any other bank of your choice. Some service providers also offer free current accounts, which you can access online. Both accounts are linked to make your funds easily transferable.

- Receive Monthly Funds: After activation, a fixed amount, e.g., €992, will be transferred to your current account each month from the blocked account. You can use this amount for rent, groceries, and daily expenses.

- Online account management: Most blocked account facility providers provide online banking facilities through which you can easily track your funds, check the balance or credit and see your transactions.

After arriving in Germany, follow these steps to activate your blocked account and receive your funds easily.

How Much Does it Cost to Open a Blocked Bank Account?

Mostly, providers charge two types of fees. One is a monthly service fee, which they deduct from your block account. Second is the setup fee, which you pay once when you open the account.

These are the top three providers, chosen by most students. Expatrio provides a very reasonable offer with a €5 monthly fee and a €69 setup fee.

Why Do I Need a Current Account?

The main reason to open a current account (Girokonto) is to receive your blocked amount (currently €992) into it, as you cannot withdraw it directly from the blocked account. Providers explicitly require you to provide details of your German current account for them to release monthly funds. Additionally, you need a current account to pay for groceries, rent, utilities, and online purchases.

Do you need a Blocked Account for the second year of your studies in Germany?

In General, students need to show proof of funds for the first year of their degree. However, after the first year of the degree, they need to extend their residence permit. Most degree programs are officially 1.5 or 2 years. In this case, proof that you can finance your studies must be provided. Proof of finances does not need to be a blocked account. It could be a partner’s or sponsor’s bank account, or your personal bank account, with enough funds to finance your stay in Germany.

In some cases, Ausländerbehorde (immigration office) can ask to extend your blocked account. Particularly when your job does not provide sufficient finances, you need to block the additional amount.

Is it Possible to Study In Germany Without a Blocked Account?

es, it is possible to study in Germany without a blocked Account. International students (from non-EU/EEA countries) must provide proof of sufficient funds to cover their stay. The first and most straightforward option is a blocked account. However, there are also alternative ways that might be accepted by the German Embassy or the local Foreigners’ Office in Germany.

- Firstly, if you have a scholarship certificate from a recognised scholarship provider, such as the German Academic Exchange Service (DAAD) or another reputable foundation.

- Secondly, you have proof of an approved student loan or Government funding in Germany.

- Thirdly, proof of sponsorship from a family member or a friend living in Germany and earning sufficient income to fund you. Your sponsor must submit a formal request to the local registration office (Ausländerbehörde) to sponsor you.

Financial support from these resources must be equivalent to the amount required for the blocked account (€992).

What If I Need to Close the Account Early?

In some cases, you can’t continue your studies and need the amount you were blocked to be returned. For example, in cases of visa application rejection, withdrawal of the visa application, changing the travel plan before travelling to Germany, or leaving Germany early. In these cases, you need to send them a visa rejection letter and other relevant documents. You will receive your money back in 3 to 4 weeks.

For example, some providers may deduct Expatrio refund fees if a visa is rejected.

Can I Get My Money Back if My Visa Application Is Rejected?

Absolutely yes, in case of visa rejection, you only need to provide the visa rejection letter from the Embassy and personal bank details to the blocked account service provider, and you will get your money back in one or two weeks. Sometimes you also get the money you paid to open a blocked account.

How Do I Withdraw Money From My Blocked Bank Account?

You can only withdraw your monthly amounts to your current account. You cannot withdraw your monthly amounts directly from your blocked account. Particularly, in some cases, you deposit additional amounts or block amounts for a year and a half instead of a year. In this case, you can only withdraw the additional amount if you spend the remaining amount. Similarly, if you need to close a bank account and there is additional money in your blocked account, you will get this remaining amount at the end when you will close your blocked account.

How do I close a blocked account?

There could be multiple reasons to close a blocked account. For example, your studies are complete, you applied for a visa but withdrew your application, or your visa application was rejected. In these cases, you need to contact the provider of your blocked account and request that it be closed. Secondly, contact your Ausländerbehörde and request a document called “Sperrfreigabe”.Provide these two above-mentioned documents and your current account, whether in Germany or the original sending account. Please keep in mind that Sperrfreigabe should not be older than 3 months. You can expect to receive your funds within a few days to a couple of weeks after your request. Generally, a blocked account will automatically close once all payouts are completed.

How Do I Extend a Blocked Bank Account?

Suppose you apply for an extension of your residence permit. You need to use a few months before your current residence permit expires. You must contact your blocked account provider, and you will find an option in the online app called “extend blocked account” or “increase funds”.

Additionally, the Ausländerbehörde will determine the amount and duration of the financial proof. Typically, this extension is for 6 or 12 months, depending on your study duration.

You must pay a one-time setup fee, which would be less than the initial opening fee. In addition, these providers, such as Fintiba and Expatrio, also charge a monthly fee for the new period. Once you transfer your new funds into your blocked account, you will receive a new blocking confirmation.

Can I Combine the Blocked Account With a Health Insurance Policy?

Many health insurance providers offer combined packages that include both health insurance and a blocked account. Some providers offer these packages for international students.

Fintiba: Offers a package called Fintiba Plus, which provides a blocked account with health insurance and travel health insurance for your stay.

Expatrio: Comprehensive coverage including travel insurance and either public student health insurance (TK – Techniker Krankenkasse) or a private plan (DR-Walter).

Coracle: Offers both essential travel insurance and your preferred student health insurance, whether that’s a public option from Techniker Krankenkasse, Barmer Krankenkasse, or IKK Gesund Plus Krankenkasse, or a private policy.

Drop Money: Coverage includes public health insurance from either Barmer Krankenkasse or Techniker Krankenkasse.

Is the €992 per Month Enough to Live In Germany?

The question is whether €992 per month for a student to live in Germany is enough. It depends on factors such as your city of residence, lifestyle, health insurance, and accommodation. Typically, a student pays for accommodation, health insurance, a semester ticket, and groceries every month. The cost of living in Germany varies depending on whether you live in a metropolitan city or a small town.

1:Accomodation

It depends on the cities; generally, accommodation in big cities such as Frankfurt, Berlin, Munich, and Stuttgart is more expensive than in smaller villages or eastern Germany.

Student Hostel (Dormitories)

However, students can stay in student hostels or dormitories, which are cheaper options. Dormitories with shared apartments are more affordable than family houses. You need to pay between €300 and €530 for student dormitories, but the range varies depending on whether you want a single room or a family apartment. To get a student hostel, you must apply 6 months before entering Germany due to long queues.

Shared Apartments or Private Apartments

Shared apartments are cheaper than student dorms, and private apartments are the most expensive. For a single-room apartment with a bathroom and kitchen, you may have to pay between €300 and € 1,200 per month, depending on the city.

2: Health Insurance

In Germany, there are two types of health insurance: private and public.

- Public health insurance is compulsory for students. Students pay between €110 and €130. Students over 30 years old pay voluntary insurance, with a minimum contribution of €220 per month.

- Private Health Insurance (PKV) in Germany offers tailored, faster-access care for ~10% of residents (self-employed, high earners, civil servants).

3: Transportation

Often covered by a semester ticket ranging from €250 to €350 per semester, depending on the university. If the university does not include the transportation fee in the semester ticket, you need to buy a monthly pass, which can cost around €50-€80.

4: Utilities

Students pay internet bills separately. Mainly, student dormitories offer these packages. These packages typically range from €30 to €55. Additionally, students can take a private monthly package from the city services, ranging from €40 to €70.

Moreover, utility bills for 1 person in big cities like Munich, Berlin, Frankfurt, Stuttgart, and Hamburg can range from €130 to €160. However, for a family of two, these utility bills can range from €212 to €250. For more information on this topic, please see the article Cost of living in Germany.

Helpful tips for an easy Blocked Account Opening

- Open a blocked account early to reduce stress and help get blocking confirmation on time.

- Choose the right provider by comparing their fees, processing times and customer reviews.

- Ensure the acceptance of the provider’s blocked account by the German Embassy.

- Choose an online or traditional. Online providers are faster compared to conventional banks. Additionally, traditional providers sometimes need a personal visit or a residence registration certificate.

- Confirm the required amount with the blocked account provider before transferring it.

- Prepare all necessary documents in advance, such as the university admission letter, proof of source of funds, and identity documents.

- Understand the international transfer methods and transfer time.

- After arriving in Germany, register your address, open a German current account, and activate your blocked account as soon as possible.

FAQ

€11,208 (€934 per month for 12 months) Yes, a Job Seeker Visa applicant must show financial proof, often through a blocked account with at least €5,604(covering 6 months at €934 per month). You can open a blocked account online with providers like Fintiba, Coracle, Expatrio, or via a German bank. The process involves:

1. Choosing a provider

2. Submitting an online application

3. Transferring the required amount

4. Receiving a confirmation of your visa application A blocked account is required for most long-term visas, including student and job seeker visas unless you have an alternative financial sponsor. Yes, if you are an International students then you need a blocked account with at least €11,208 to prove financial stability during your studies. Coracle serves international students and job seekers coming to Germany by providing a blocked account with key advantages: quick setup, transparent pricing, and accessible direct support." Fintiba stands out as a highly popular German blocked account provider, distinguished by its fully digital platform, swift approval times, and convenient health insurance integration." Yes, alternatives include:

• A formal obligation letter (Verpflichtungserklärung) from a sponsor in Germany

• A scholarship covering living expenses

• A secured bank guarantee To withdraw money, you must first open a local German bank account (Girokonto) and link it to your blocked account. Your blocked account provider will then transfer the allowed monthly amount (€934 in 2025) to your German bank account. Yes, to activate the account, you need to verify your identity and provide proof of residence (Anmeldung) and your visa/residence permit. You can only withdraw the fixed monthly amount (€934 in 2025) unless you have special approval from immigration authorities or close the account. The money is transferred automatically from your blocked account to your German bank account every month. You can then withdraw it via ATMs, online banking, or card payments. If you leave Germany or your visa is rejected, you can request account closure and get a refund. You will need to provide official proof (e.g., visa rejection letter or flight ticket). You will recieve money in monthly installments in your German current account. You can't withdraw money directly from your blocked account To prove financial stability for your visa, a blocked account (Sperrkonto) is required. This special bank account restricts monthly withdrawals, guaranteeing you'll have sufficient funds throughout your stay in Germany. Yes, you can deposit additional funds but you will recieve remaining amount after closing the blocked account. It takes 1 to 3 working days for account setup

3 to 7 working days for fund transfer and confirmation

1 to 2 working days for activation after arrival Coracle: speedy customer support, no monthly account fees, and a variety of health insurance choices.

Fintiba: Opt for Fintiba for a fully digital experience, rapid application approvals, and a competitive fee structure.

Expatrio: comprehensive bundled packages that seamlessly combine health insurance with blocked account services. Yes, mostly blocked account providers allows you to open blocked account from your home country. No, monthly withdrawal limit is fixed. After expiration of visa you can withdraw the remaining amount into your current German account. yes, its your amount and you have to choose where you want to spend it. yes, around €50-€100 one-time setup fee and around €5-€10 monthly maintenance fee. Mostly providers clearly states if there is any fee. However, you should always check currency exchange fee or international transfer fees. yes you can but keep in mind it's always time consuming and have some charges. Always choose wisely for the first time to avoid unnecessary stress. No, you can open an account online from, your home country. yes, you can use it for family reunion visa but amount to block depends on the number of family members. Delays are uncommon but can occur, contact with your provider or customer support immediately. yes, in case you have proof of another financial support such as job or scholarship. Activation of blocked account is necessary to get your monthly funds. if you don't activate it, your funds will remain blocked. contact your provider. Customer support is 24/7 available.